In July, the Metro Vancouver Regional District board passed a new policy to value GHG emission reductions at $150/ tonne (constant, nominal) CO2e in the evaluation of capital projects. This price is inclusive of externally imposed carbon prices, i.e. B.C.’s existing $30/ tonne carbon tax. Metro Vancouver will be incorporating this price into Life Cycle Cost Analyses of projects and initiatives. It plays two main roles: setting a value of emission reductions when comparing alternative projects, and helping reduce Metro Vancouver’s exposure to potentially higher carbon prices in the future.

Long-term infrastructure decisions, like those made by Metro Vancouver, require a realistic forecast of future carbon costs. Making long-term investment decisions based on current prices alone can mean under-investment in carbon reductions and higher future costs. Unfortunately, there are few credible forecasts for carbon prices. Governments have established aggressive reduction targets, but today’s policies don’t match the targets. Private investors will tend to distrust future targets when governments have failed to implement policies to meet past targets. Public sector and private organizations are moving to place internal values on carbon. Metro Vancouver is ahead of the curve and is using their investment criteria to show leadership while helping manage their own carbon liabilities.

Senior levels of governments have already signaled some increase in carbon prices. The federal government has proposed a national floor on carbon prices of $50/ tonne by 2022. This is a necessary but not sufficient step to achieve national reduction targets, so further increases and/or other policies are likely. The Confidence and Supply Agreement between the BC Green Caucus and the BC New Democrat Caucus suggests a commitment to increase the B.C. Carbon tax $5 per year starting in 2018. The agreement does not include any end date for the price increases. However, neither of these proposals has been put into law yet (see recent update on federal proposal here) and private investors are likely to attach less weight to these commitments until they become law.

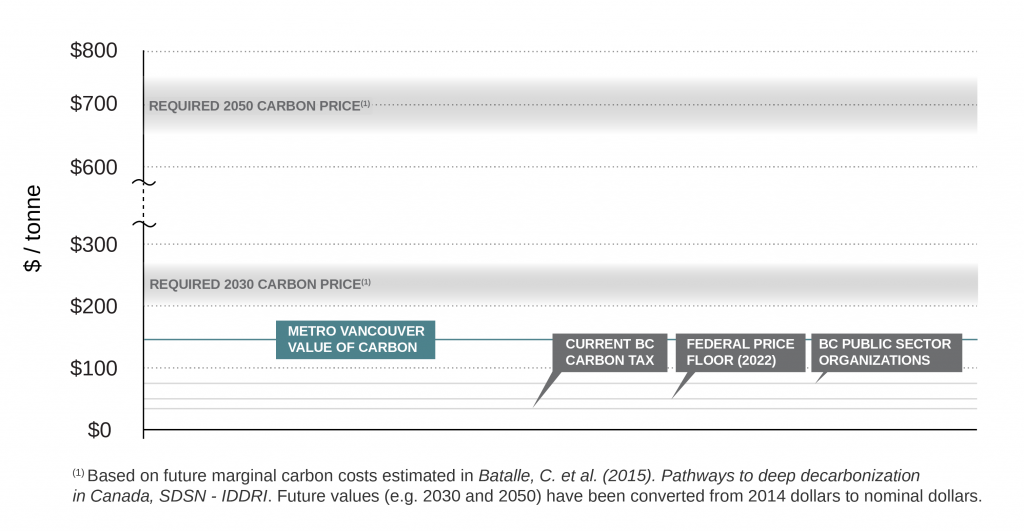

So what is the upper bookend for the price of carbon? First, we need to recognize that targets may not be achieved solely through carbon pricing – governments will likely use a mix of pricing and sector-specific regulations – but sector-specific regulations should have comparable if not higher implicit costs of abatement. There are several credible studies of the marginal abatement cost to achieve current carbon reduction targets. The figure below shows the substantial gap between existing carbon taxes and offset costs in B.C., and required prices to achieve reduction targets in 2030 and 2050.

Most abatement cost studies agree that prices should be ratcheted up incrementally (e.g. $10 per year increases), so in a perfect world everyone would face a highly credible future carbon price schedule with consistent year-on-year increases reaching the 2030 and 2050 price levels shown above. While Metro Vancouver’s new policy isn’t that aggressive (and only applies to their internal decision making), it comes much closer to the mark than B.C.’s current carbon policies.

Trent Berry, Will Cleveland, and Keegan Balcom