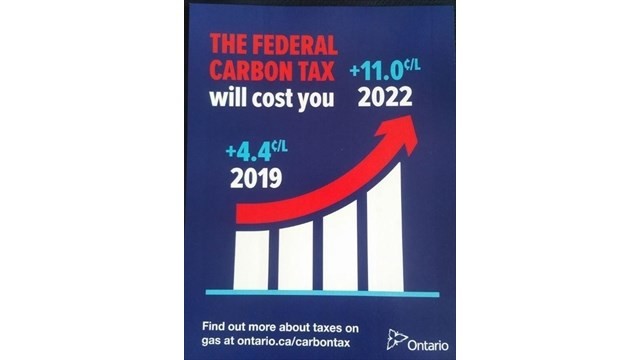

The idea of carbon pricing in Canada has been in the news a fair bit lately – and the stories are not all positive. We are seeing gas pump stickers in Ontario, four Provinces challenging the Federal Government’s jurisdiction, and anti-climate action pundits taking aim at this form of climate policy.

Where my mind goes in the wake of these recent events is not to double down on the argument for carbon pricing, but rather to think more about why some more ‘covert climate policies’ (aka regulations) have made a meaningful impact on GHG emissions, without all of the political backlash.

Have there been effective climate policies in the recent past?

Two major policies that come to mind, and are often cited as success stories, are the phase-out of coal-fired electricity in Ontario and BC’s Clean Energy Act (in particular, the requirement that all new electricity generation be clean). These two policy measures have made a dramatic impact on the GHG inventory of both provinces, and are by and large accepted as the status quo, with a fraction of the acrimonious debate that swirls around carbon pricing.

In the decades since these pieces of legislation have been in place we’ve seen the carbon intensity of the Ontario grid plummet, and BC Hydro’s carbon intensity remain at very low levels despite a growing demand for electricity.

Yes, rates have gone up in both provinces, but rarely do we see blame for rate hikes placed on the coal phase out (cancelled gas contracts, nuclear refurbishment costs, and high FIT contracts all get their fair share). In B.C., there is push back on Hydro rate increases, but the perceived culprits are IPPs and Site-C. While BC Hydro likely could have developed new gas-fired generation at low cost, consumers generally don’t get their electricity bill and say, “I could have been paying less if the government allowed new gas-fired power plants to be built in B.C.”

Why did these policies fly under the radar (compared to carbon taxes in 2019)?

I submit that this is because when governments regulate at the technology (i.e. coal phase out) or outcomes level (i.e. only clean energy for new power), the general public more easily accepts this as the cost.

It is difficult to speculate on why this is. Maybe it is because when it is delivered as an acute taxation on the gas we buy at the pump, or monthly fuel bills to heat our homes, some people see it as an afront to their life-style choice: of being singled out for the circumstance they are in, or choices they’ve made as being ‘bad’. I don’t have the background or evidence to say why – just making the observation that it is the case.

Others have made this point as well. There was a recent well-written article that talks about a strategic retreat from carbon pricing. The author provides this quote from climate economist Mark Jaccard:

“’Carbon pricing is not essential to stop burning coal and gasoline,’ he wrote in the Globe and Mail last year. ‘We economists only say it is because we prefer it. If we were honest, we would explain that decarbonization can be achieved entirely with regulations.’”

The article goes on to say,

“The Clean Fuel Standard that’s being developed right now is probably as well known in this country as the name of Regina’s tallest building, but it’s expected to reduce Canada’s annual GHG emissions by 30 megatonnes by 2030—and without attracting any public attention or political fire.”

For those of us that work in the building sector, this is one to watch. If fuel for buildings comes in scope for the Clean Fuel Standard, it could accelerate the adoption of renewables in the heating and cooling sector. Although as my colleague Trent Berry notes, other regulations may still be required to achieve deep and cost-effective reductions in the building sector.

How do they compare on a $/tonne basis with the carbon pricing we see in with 2019 carbon taxes?

My Reshape colleague Will Cleveland likes to crunch the numbers on carbon abatement costs in his spare time (see his recent post on ‘Negative Emissions at $100/tonne?”), so I collaborated with him to work out an implicit or shadow value of carbon for a few climate regulations and incentive programs.

- ON Coal Phase out (> $100/tonne)

- BC Clean Electricity (> $100/tonne)

- CoV Climate Policies* (> $250/tonne)

- Fortis BC Renewable Natural Gas (RNG) (>$250/tonne)

- ON&BC Electric vehicle incentives (>$250/tonne)

* Mandatory connection to SEFC, Zero Emission’s Building Plan

The shadow value of carbon (i.e. what would the carbon tax have to be in order to make a fossil fuel alternative cost-neutral with the what is permitted/required/incentivized) is much higher than the carbon tax in 2019. In all cases, it is multiple times higher, and in some cases, an order of magnitude higher.

The behavioral economics of this are further confounding when you consider that the carbon tax is revenue neutral. Lots has been written on this, and the debate goes on about who gets more or less back. The point I’ll make here is that individuals get most (if not all, and then some) of the carbon tax back.

In the case of coal phase-out or renewable requirements for new power, individuals only pay more for electricity. Not only are they paying more per tonne than under existing carbon taxes – they also are not getting any rebate. Yet we see gas pump sticker campaigns, courtroom battles, and trenches being dug for the next Federal election campaign on account of a $20-50/tonne carbon taxes.

The point of all this is not to say we should abandon carbon taxes, or that regulation is the only answer. Rather, it is that we should develop climate policy that takes into account human nature. In Misbehaving: The Making of Behavioural Economics, Richard Thaler makes the point that often we don’t pursue our own economic best interest. Businesses have clued into this for decades – and have made money from this insight. It is time policy makers to more closely consider the behavioural response to climate policy as well.

Carbon pricing may be the most economically rational way to approach climate policy, but it may not be the one that will result in the most meaningful climate action.

Lastly, I have to wonder if things would have panned out differently if policymakers had decided to communicate carbon taxes on a $/kg basis. Twenty buck a tonne might sound like a lot. But 2 cents a kg of CO2e – why that is nothing!????

Gerard MacDonald